Renters Insurance in and around Bakersfield

Bakersfield renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Think about all the stuff you own, from your laptop to smartphone to camping gear to pots and pans. It adds up! These personal items could need protection too. For renters insurance with State Farm, you've come to the right place.

Bakersfield renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Renters Insurance You Can Count On

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance could cover the cost of damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps safeguard your personal possessions in case of the unexpected.

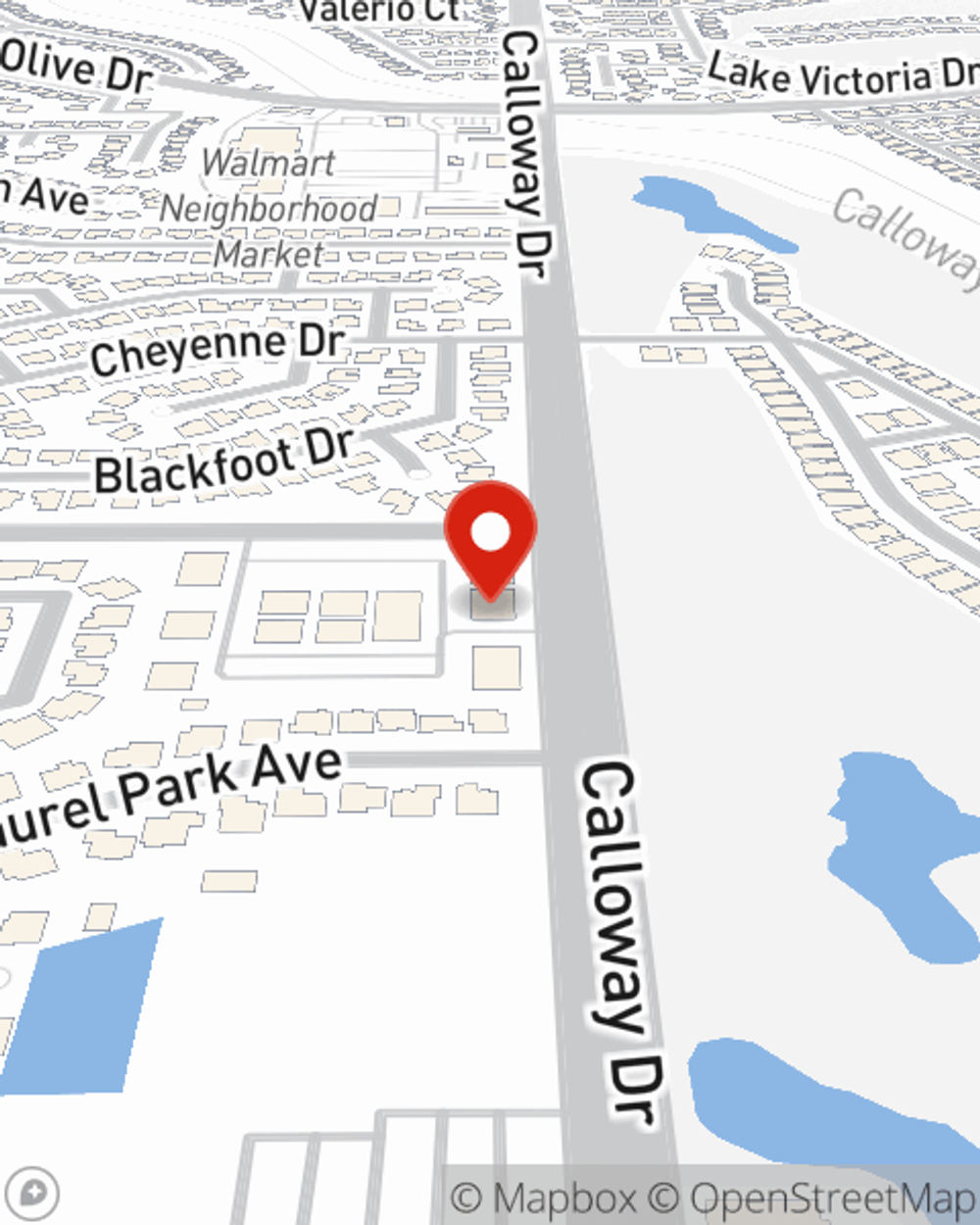

More renters choose State Farm® for their renters insurance over any other insurer. Bakersfield renters, are you ready to discuss your coverage options? Get in touch with State Farm Agent Darlene Denison today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Darlene at (661) 588-6070 or visit our FAQ page.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Darlene Denison

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.